2025 Legislative Changes Affecting Commercial Solar Projects

The One Big Beautiful Bill Act was signed into law on July 4th, 2025 effectively phasing out tax incentives for photovoltaic solar systems.

- Projects that have 5% down payment by July 4th, 2026, retain safe harbor and are given 4 years to complete

- Projects that receive 5% down payment after July 4th, 2026, need to be completed by December 31st, 2027 to qualify for the 30% federal tax credit

- Get an updated quote

- Get a purchase agreement signed early 2026

- Make a downpayment of at least 5% by June 2026

- Get your project on the construction schedule

- (Projects that fulfill these steps will have up to 4 years to complete the project construction and still receive the 30% federal tax credit)

- Projects under 1.5 MW AC must have contract signed and a 5% down payment prior to July 4th, 2026.

- Renewable Energy Systems can only schedule 10-12 commerical projects a year

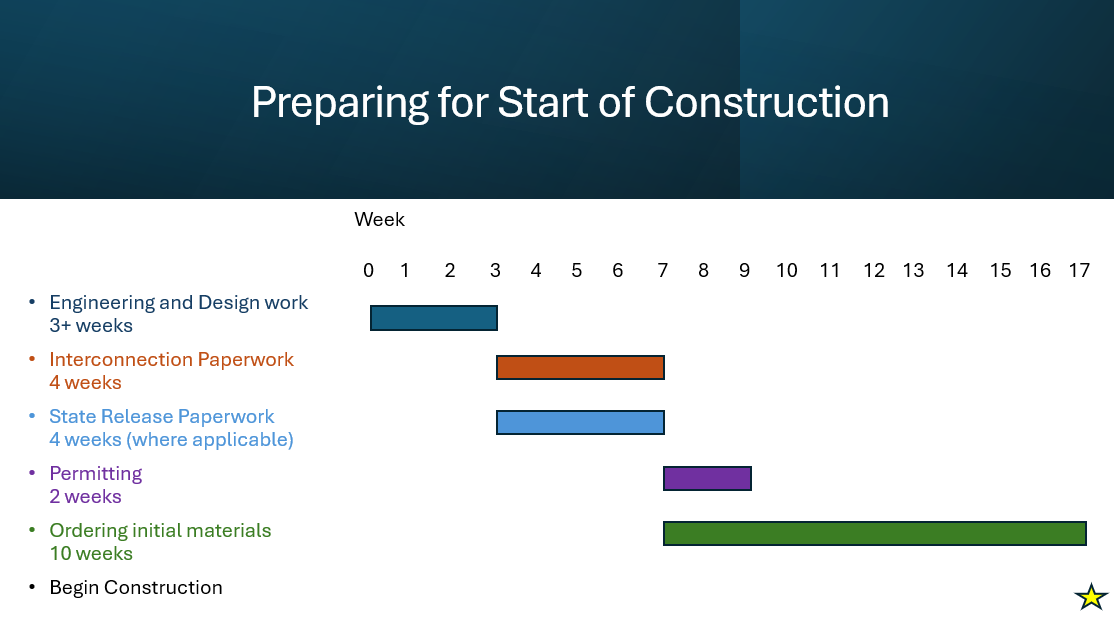

- Typically projects require 17 weeks from contract to start of physical construction

Schedule and capacity is based on a first come first serve bases. Earlier quotes provide a greater safe harbor opportunity.

Nonprofits also benefit from safe harbor by meeting the above requirements. Instead of recieving the 30% Federal tax credit nonprofits are elgible for direct pay.